Popular Posts

Due Diligence Auditing Services in Dubai

Due diligence auditing is a comprehensive process of evaluating a business or investment opportunity before finalizing any major transaction. It involves a meticulous examination of financial records, legal obligations, operational performance, and potential risks associated with the business in question. The primary objective is to ensure that all critical information is disclosed and that the decision-makers are fully informed before proceeding with a deal.

External Audit Services in Dubai, UAE

Dubai, a global financial hub, is home to a dynamic and rapidly evolving business environment. With its strategic location, business-friendly regulations, and robust infrastructure, the city attracts businesses from around the world. One critical aspect of maintaining trust and transparency in this thriving marketplace is the role of external audit services.

Trade license Oman

Oman, a key player in the Gulf Cooperation Council (GCC), offers a favorable business environment for entrepreneurs and corporations. A crucial first step for anyone looking to start a business in Oman is obtaining a trade license. This guide provides an overview of the types of trade licenses available, the application process, and the benefits of setting up a business in Oman.

Audit Services in Oman

Audit services play a critical role in maintaining the integrity of financial reporting and enhancing the trust of stakeholders in the financial health of a business. In Oman, a country with a rapidly growing economy and an increasingly complex business environment, the importance of reliable audit services cannot be overstated. This article provides an in-depth look at audit services in Oman, covering their significance, regulatory framework, and the types of audits available to businesses.

What is the Benefit for Business in Dubai?

Dubai has rapidly emerged as a global business hub, attracting entrepreneurs and multinational corporations alike. Establishing a company in Dubai offers numerous advantages that make it a preferred destination for businesses across various industries.

Trade License Dubai

A trade license in Dubai is an official document issued by the Dubai Department of Economic Development (DED) that permits businesses to operate within the emirate. The license defines the nature of the business activity and ensures that the company complies with Dubai's laws and regulations.

Audit Services in Dubai

Dubai, one of the world's most dynamic business hubs, has seen rapid growth in its economy over the past few decades. This growth has created a demand for robust financial systems, including auditing services. Auditing in Dubai is not only a legal requirement for many businesses but also a strategic tool that helps organizations maintain transparency, enhance credibility, and improve operational efficiency. This article explores the landscape of auditing services in Dubai, highlighting their importance, regulatory environment, and key players in the market.

Which is best state to Register Company in US

Delaware is well known for being the most business-friendly state for corporations. According to the Delaware Division of Corporations 2021 Annual Report, 66.8% of all Fortune 500 companies are incorporated in Delaware.

COMPANY REGISTRATION IN UAE

Company Registration in UAE is a process of the prime destination for entrepreneurs and businesses due to its strategic location, tax-free environment, and world-class infrastructure. Registering a company in the UAE involves several key steps and offers various options tailored to different business needs.

VAT in Dubai (UEA)

Value Added Tax (VAT) is an indirect tax levied on the consumption of goods and services. It is a crucial source of revenue for many governments worldwide. Dubai, part of the United Arab Emirates (UAE), implemented VAT on January 1, 2018, following the GCC VAT framework agreement.The Federal Tax Authority (FTA) oversees the implementation and regulation of VAT in Dubai. The VAT rate in Dubai is set at 5%, applicable to most goods and services. However, certain goods and services are zero-rated or exempt from VAT.

How to Apply for a Social Security Number (SSN) in the USA

A Social Security Number (SSN) is a critical identifier for anyone living and working in the United States. It is used for a variety of purposes, including tracking earnings, filing taxes, and accessing government services. Whether you are a U.S. citizen, a permanent resident, or a non-citizen authorized to work, obtaining an SSN is an important step. This article provides a comprehensive guide on how to apply for an SSN in the USA.

About Australia's transfer pricing

Australia's transfer pricing rules are an essential component of its tax regime, designed to prevent multinational enterprises (MNEs) from shifting profits to low-tax jurisdictions and thereby eroding the Australian tax base. These rules ensure that transactions between related parties, such as subsidiaries and parent companies, reflect arm's length conditions—that is, the conditions that would be expected between independent parties in comparable circumstances.

Company Registration in USA

The United States is a popular destination for foreign businesses looking to expand their operations. The country has a strong economy, a large and growing market, and a favorable business environment. Registering a company in the USA involves several steps, which can vary depending on the state and the type of business structure you choose. Here is a general guide:

Income Tax Rates in the USA

The United States employs a progressive income tax system, where tax rates increase as income increases. This system aims to ensure that individuals and businesses contribute to federal revenues based on their ability to pay. Understanding the income tax rates and their application is crucial for taxpayers to navigate their financial obligations effectively.

Double Taxation Avoidance Agreement (DTAA) between India and the USA

The Double Taxation Avoidance Agreement (DTAA) is a tax treaty signed between India and the United States (USA) to help taxpayers avoid paying double taxes on the same income. This agreement fosters economic cooperation and provides relief from the burden of double taxation for residents of both countries.

Top 5 Clouds based Accounting Software in World

Cloud-based accounting software has revolutionized financial management for businesses by offering accessibility, real-time updates, and enhanced security. Here are five of the best cloud-based accounting software solutions available globally:

Top 5 Payroll Software for Australia

Managing payroll efficiently is crucial for businesses to ensure compliance with regulations and to maintain employee satisfaction. Here are the top five payroll software solutions for Australian businesses:

Top 5 Payroll Software for USA

Efficient payroll management is crucial for businesses of all sizes, ensuring timely and accurate employee compensation. In 2024, the top payroll software options for businesses in the USA are leading the way with advanced features, user-friendly interfaces, and reliable customer support. Here are the top five payroll software solutions:

Roth IRA

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free.

Personal Income Tax Rates in Australia

Personal income tax in Australia is a key revenue source for the government, funding essential public services such as healthcare, education, and infrastructure. Understanding how these tax rates are structured can help residents manage their finances more effectively.

Top 5 income tax software in the Australia

MYOB: MYOB is renowned for its comprehensive features that cater to both small businesses and larger enterprises. It offers a user-friendly interface, making it easy to track expenses, manage payroll, and file taxes accurately. Its cloud-based system allows users to access their data anytime, anywhere, ensuring seamless tax management.

Old Age, Survivors, Disability Insurance (OASDI) Program

Old-Age, Survivors, and Disability Insurance (OASDI) program, stands as a cornerstone of social welfare in the United States. Established in 1935 as part of President Franklin D. Roosevelt's New Deal, its purpose was to provide financial security to retirees, disabled individuals, and survivors of deceased workers. Initially, the program focused on providing retirement benefits to workers aged 65 and older. Over the years, the program has expanded to include survivors of deceased workers and individuals with disabilities, reflecting a broader understanding of social insurance needs.

Understanding the Medicare Tax

The Medicare tax is a federal payroll tax designed to fund the Medicare program, which provides health insurance to Americans aged 65 and older, as well as to younger people with certain disabilities. It is part of the Federal Insurance Contributions Act (FICA) and is paired with the Social Security tax. This article provides an overview of the Medicare tax, including its rates, who pays it, and a practical example.

Top 5 Income Tax Software in the USA

1.TurboTax TurboTax is one of the most popular and widely used tax preparation software in the USA, known for its user-friendly interface and comprehensive features. It offers various editions tailored to different tax situations, including TurboTax Free Edition for simple tax returns, TurboTax Deluxe for homeowners and deductions, TurboTax Premier for investments and rental properties, and TurboTax Self-Employed for freelancers and small business owners. TurboTax guides users through the filing process with step-by-step instructions, checks for potential deductions, and offers features like W-2 import and audit support.

Social Security Tax

Social Security tax, also known as the Federal Insurance Contributions Act (FICA) tax, is a payroll tax levied on both employees and employers in the United States. It funds the Social Security program, which provides retirement, disability, and survivor benefits to eligible individuals. Here’s an in-depth look at what Social Security tax entails, its calculation, and its impact:

Federal Unemployment Tax Act (FUTA)

The Federal Unemployment Tax Act (FUTA) is a crucial piece of legislation in the United States designed to provide funding for state unemployment insurance programs. Enacted in 1939 during the New Deal era, FUTA aims to support workers who become unemployed through no fault of their own, ensuring they have access to temporary financial assistance while they seek new employment opportunities.

When gift are taxed in Australia

In Australia, while most personal gifts between family members and friends are generally tax-free, certain scenarios can trigger taxation implications. It's crucial to understand when the Australian Taxation Office (ATO) considers a gift to be assessable income or subject to capital gains tax (CGT):

Payroll Accounting in the USA

Payroll accounting in the United States is a crucial function for businesses of all sizes, ensuring employees are paid accurately and timely while complying with various federal and state regulations. Here’s an overview of the key aspects of payroll accounting in the USA:

Average Indexed Monthly Earnings (AIME)

AIME represents an individual's average earnings over their working life, adjusted for inflation. The adjustment process ensures that the earnings from earlier years, which were typically lower due to inflation, are appropriately scaled up to reflect their value in today's dollars. This adjustment is done using the national average wage indexing series, which helps to maintain the purchasing power of the earnings over time.

How Property Tax is Calculated in the USA

Property tax is a major revenue source for local governments in the U.S., funding services like schools and emergency services. Understanding property tax calculation helps homeowners anticipate expenses and potentially reduce their tax burden. Here’s a concise guide to the process:

Understanding Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return

Form 709, known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is an important document for U.S. taxpayers who make significant gifts or transfers. This form is essential for reporting taxable gifts and certain transfers that skip generations, ensuring compliance with the Internal Revenue Service (IRS) regulations.

Gift Tax in the USA

The gift tax in the United States is a federal tax imposed on the transfer of property by one individual to another while receiving nothing or less than full value in return. The gift tax applies to the transfer of money or property to another person without receiving something of equal value in return. The giver, known as the donor, is generally responsible for paying the gift tax. However, there are numerous exemptions and exclusions that allow many gifts to be transferred without incurring tax liability.

No Income No Tax

DTAA (Double Taxation Avoidance Agreement) is a tax treaty signed between two or more countries to help taxpayers avoid paying double taxes on the same income. For Non-Resident Indians (NRIs), this agreement is particularly important as it helps them avoid being taxed twice on income earned in India and their resident country.

Understanding Australia's PAYG System

Australia's Pay As You Go (PAYG) system, managed by the Australian Taxation Office (ATO), simplifies tax collection for individuals and businesses by collecting income tax progressively throughout the year. It consists of two main components: PAYG Withholding and PAYG Instalments. Employers withhold taxes from payments to employees and contractors, remitting them to the ATO. Meanwhile, individuals and businesses making income not subject to withholding, such as from investments or business profits, make regular prepayments towards their annual tax liability.

Save Capital Gains Tax

Reducing capital gains tax in the United States can be achieved through several strategies. Holding investments for over a year is one common method, as long-term capital gains (on assets held for more than one year) are taxed at lower rates than short-term gains (on assets held for one year or less). Long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income, whereas short-term gains are taxed at ordinary income tax rates. Another effective strategy is to use tax-advantaged accounts, such as 401(k)s, IRAs, Roth IRAs, or Health Savings Accounts (HSAs). These accounts offer tax deferral or tax-free growth, significantly reducing capital gains taxes.

Itemized deductions vs Standard deduction

Itemized deductions are essentially a list of expenses you can use to reduce your taxable income on your federal tax return. They include medical expenses, taxes, the interest you pay on your home mortgage, and donations to charity. Taxpayers who itemize add up all of their deductible expenses and subtract the total from their adjusted gross income to reach their taxable income.

Understanding Form 1120: U.S. Corporation Income Tax Return

Form 1120, the standard tax form used by C corporations in the United States, is essential for reporting their financial information to the IRS. This form details a corporation’s income, expenses, and other financial activities over the tax year, enabling the IRS to assess the corporation’s tax liability. It must be filed annually, regardless of whether the corporation made a profit or incurred a loss during the year.

Form 1040 NR

Form 1040-NR, also known as the U.S. Nonresident Alien Income Tax Return, is a critical document for nonresident aliens who have earned income from U.S. sources. Nonresident aliens are individuals who do not pass the green card test or the substantial presence test, which are the primary criteria for determining residency status for tax purposes in the United States. This form is essential for reporting and paying taxes on various types of income earned within the U.S., such as wages, salaries, tips, interest, dividends, and other forms of compensation.

What Is an S Corp?

An S Corporation, or S-corp, is a unique corporate structure that offers the liability protection of a corporation while enjoying the tax benefits of a partnership. The "S" designation refers to Subchapter S of the Internal Revenue Code, which outlines the specific tax rules for this type of corporation.

Payroll management is a critical aspect of organizational efficiency and tax withholdings.

Payroll management is a critical aspect of organizational efficiency, encompassing the administration of employee compensation, benefits, and tax withholdings. Efficient payroll systems ensure timely and accurate payments, fostering employee satisfaction and compliance with legal obligations.

Digital Transformation

Digital transformation has revolutionized bookkeeping, ushering in a new era of efficiency and accuracy. Traditional ledgers and manual record-keeping have given way to sophisticated digital tools, reshaping the landscape of financial management.

Hedge fund accounting

Hedge fund accounting is a specialized field that plays a crucial role in managing the financial intricacies of hedge funds, investment vehicles known for their complex strategies and risk profiles.

Outsourcing accounting, taxation, and payroll in the USA offers cost savings by reducing in-house staffing and operational expenses. It ensures compliance with tax laws and regulations through expert handling, minimizing risks of errors and penalties. Additionally, it frees up time for businesses to focus on core operations and strategic growth.

In Dubai, outsourcing accounting services includes bookkeeping, financial reporting, and audits to ensure compliance with UAE regulations. Taxation outsourcing helps businesses manage VAT filings, tax planning, and adherence to local tax laws. Payroll outsourcing streamlines salary processing, WPS compliance, and employee benefits, ensuring efficiency and accuracy in HR functions.

Outsourcing in accounting involves delegating tasks such as bookkeeping, financial reporting, and audits to external firms. Payroll outsourcing handles salary processing, tax calculations, and employee benefit management. Taxation outsourcing focuses on filing tax returns, tax planning, and ensuring compliance with local and international tax laws.

Outsourcing accounting provides cost savings by reducing the need for in-house staff and infrastructure. It ensures access to expert financial management and up-to-date compliance with regulations. Additionally, it allows businesses to focus on core activities, improving efficiency and growth.

Cloud accounting is the practice of using internet-based software to manage and process financial transactions, records, and reporting. Unlike traditional accounting systems that are installed locally on computers, cloud accounting solutions are hosted on remote servers and accessible from anywhere with an internet connection. These systems provide real-time data updates, improved collaboration, and enhanced security. Popular examples include QuickBooks Online, Xero, and Zoho Books.

Accounting outsourcing involves hiring external service providers to handle a company's accounting and financial tasks, such as bookkeeping, payroll, tax preparation, and financial reporting. It helps businesses reduce costs, access expert services, and focus on core activities. This approach is popular among companies seeking efficiency and scalability.

Oman's business landscape has evolved significantly in recent years, with efforts to diversify the economy away from oil dependence. The government’s Vision 2040 development plan promotes sectors such as tourism, logistics, manufacturing, and technology. The regulatory framework is supportive, particularly for foreign investors, and Oman’s free trade agreements, modern infrastructure, and investor-friendly policies make it an attractive destination for business.

Due diligence auditing is a comprehensive process of evaluating a business or investment opportunity before finalizing any major transaction. It involves a meticulous examination of financial records, legal obligations, operational performance, and potential risks associated with the business in question. The primary objective is to ensure that all critical information is disclosed and that the decision-makers are fully informed before proceeding with a deal.

In Dubai, UAE, statutory auditors play a critical role in ensuring the financial integrity and transparency of businesses. As Dubai continues to grow as a global business hub, the importance of adhering to financial regulations and maintaining accurate financial records has become paramount. Statutory auditors, who are independent third-party professionals, are mandated by law to audit the financial statements of companies, ensuring compliance with applicable regulations and standards.

Dubai, a global financial hub, is home to a dynamic and rapidly evolving business environment. With its strategic location, business-friendly regulations, and robust infrastructure, the city attracts businesses from around the world. One critical aspect of maintaining trust and transparency in this thriving marketplace is the role of external audit services.

Internal auditing plays a crucial role in ensuring the smooth and efficient operation of businesses, especially in a dynamic and rapidly growing market like the United Arab Emirates (UAE). As organizations in the UAE expand, diversify, and navigate complex regulatory landscapes, the need for a robust internal audit function becomes increasingly important. This article explores the significance of internal auditing in the UAE, its key functions, and how it supports organizational governance, risk management, and compliance.

The introduction of corporate tax in the UAE marks a significant change in the business landscape. To navigate this new terrain effectively, businesses need to understand the accounting standards and methods relevant to UAE corporate tax. Below is a concise guide to help businesses stay compliant and optimize their tax position.

Oman, a key player in the Gulf Cooperation Council (GCC), offers a favorable business environment for entrepreneurs and corporations. A crucial first step for anyone looking to start a business in Oman is obtaining a trade license. This guide provides an overview of the types of trade licenses available, the application process, and the benefits of setting up a business in Oman.

Oman, located in the southeastern corner of the Arabian Peninsula, has emerged as a significant player in the Gulf Cooperation Council (GCC) due to its strategic location, political stability, and growing economy. Over the years, the country has implemented various economic reforms to attract foreign investment and diversify its economy, reducing its reliance on oil revenues. One of the critical components of these reforms is the development and enforcement of tax laws, including the Income Tax Law.

Audit services play a critical role in maintaining the integrity of financial reporting and enhancing the trust of stakeholders in the financial health of a business. In Oman, a country with a rapidly growing economy and an increasingly complex business environment, the importance of reliable audit services cannot be overstated. This article provides an in-depth look at audit services in Oman, covering their significance, regulatory framework, and the types of audits available to businesses.

The United Arab Emirates (UAE) introduced Value Added Tax (VAT) on January 1, 2018, as part of its efforts to diversify its economy and reduce dependence on oil revenue. Here’s a breakdown of key points regarding VAT registration in the UAE:

Corporate Tax and Value Added Tax (VAT) are two distinct forms of taxation, each targeting different aspects of economic activity. Here’s a breakdown of their key differences:

The United Arab Emirates (UAE) has implemented various tourism taxes to support the development of its hospitality and tourism sector. These taxes are applied to hotel stays, restaurant bills, and other services related to tourism. Here’s a brief overview:

Value Added Tax (VAT) is a relatively new concept in Oman, having been implemented on April 16, 2021, as part of the country’s broader economic reforms. The introduction of VAT in Oman is a significant milestone, aimed at diversifying the nation’s revenue sources and reducing reliance on oil. This article provides an in-depth look at VAT in Oman, exploring its key features, implementation, and impact on businesses and consumers.

Oman, located on the southeastern coast of the Arabian Peninsula, is known for its strategic location, rich culture, and growing economy. Over the years, the Sultanate has implemented various economic reforms to attract foreign investment, diversify its economy, and reduce its reliance on oil revenues. One such reform is its corporate tax regime, which plays a crucial role in shaping the business environment in the country.

Dubai, a leading global financial hub, offers a business-friendly environment with a robust regulatory framework. However, even in such an efficient system, tax disputes can arise. Understanding how to resolve these disputes effectively is crucial for businesses operating in the emirate.

The United Arab Emirates (UAE), including Dubai, has long attracted businesses due to its favorable tax environment, strategic location, and robust infrastructure. However, to align with global standards and prevent harmful tax practices, the UAE introduced the Economic Substance Regulations (ESR) in 2019, which were later amended in 2020. These regulations require businesses to demonstrate substantial economic activities within the UAE, ensuring compliance with international norms.

Before diving into tax planning, it’s crucial to understand the basics of the Corporate Tax Law introduced in the UAE, which applies to companies across all emirates, including Dubai. As of June 2023, the UAE implemented a federal Corporate Tax at a rate of 9% on business profits exceeding AED 375,000. This law applies to all businesses except for those operating in natural resource extraction, which remain subject to emirate-level taxation.

India and Oman have shared a longstanding relationship marked by strong economic ties, cultural exchanges, and mutual respect. In recent years, trade between the two nations has grown significantly, reflecting their commitment to enhancing economic cooperation. This article explores the evolving trade dynamics between India and Oman, highlighting the opportunities and challenges that lie ahead.

Dubai, a thriving global business hub, offers an attractive environment for companies, but understanding and complying with its sales tax regulations is crucial for maintaining smooth operations. Here’s a comprehensive guide to sales tax return filing and the relevant laws in Dubai.

Transfer pricing refers to the pricing of goods, services, or intangibles between related entities within a multinational corporation. It is crucial for ensuring fair taxation and compliance with local regulations. This article compares the transfer pricing concepts in Dubai and India, highlighting key differences and similarities.

India and Dubai share a robust and dynamic trade relationship, fueled by historical ties, strategic proximity, and complementary economies. Over the years, Dubai has become a crucial gateway for India's trade with the Middle East and Africa, while India is one of Dubai's top trading partners. This bilateral trade is characterized by diversity, ranging from energy and precious metals to textiles and electronics.

Dubai, one of the seven emirates that make up the United Arab Emirates (UAE), has gained global recognition for its dynamic economy, thriving business environment, and luxurious lifestyle. One of the key factors contributing to Dubai’s appeal, particularly for expatriates, is its favorable tax regime. Unlike many other parts of the world, Dubai offers a unique proposition: no personal income tax. This article delves into the details of individual taxation in Dubai, exploring its implications for residents and expatriates.

Dubai has long been a beacon for international businesses, attracting corporations with its strategic location, world-class infrastructure, and a reputation as a global business hub. However, one of the most significant factors driving investment in Dubai has been its favorable tax environment. In recent years, the introduction of corporate tax has added a new dimension to this landscape. While taxes are typically viewed as a financial burden, corporate tax in Dubai offers a range of benefits that can contribute positively to the economy and the business environment.

Dubai, a global hub for business and innovation, offers entrepreneurs and companies a wide range of opportunities to establish and grow their ventures. One of the most attractive options for setting up a business in Dubai is within one of its many free zones. These special economic areas are designed to encourage foreign investment by offering benefits such as 100% foreign ownership, tax exemptions, and simplified business setup processes. Here’s a comprehensive guide on how to establish a company in a Dubai free zone.

Dubai has rapidly emerged as a global business hub, attracting entrepreneurs and multinational corporations alike. Establishing a company in Dubai offers numerous advantages that make it a preferred destination for businesses across various industries.

Dubai, one of the seven emirates of the United Arab Emirates (UAE), is a global business hub known for its strategic location, modern infrastructure, and business-friendly environment. Whether you're a local entrepreneur or an international investor, Dubai offers numerous opportunities to establish and grow your business. However, starting a business in Dubai requires careful planning, understanding the legal framework, and making informed decisions. This guide will walk you through the key steps involved in starting a business in Dubai.

Obtaining a Dubai trade license is essential for starting a business in the emirate. Here’s a concise guide to help you navigate the process:

A trade license in Dubai is an official document issued by the Dubai Department of Economic Development (DED) that permits businesses to operate within the emirate. The license defines the nature of the business activity and ensures that the company complies with Dubai's laws and regulations.

The Dubai Financial Services Authority (DFSA) is an independent regulatory body tasked with overseeing and regulating financial services within the Dubai International Financial Centre (DIFC). Established in 2004, the DFSA is central to ensuring that Dubai’s financial sector operates with high standards of integrity, transparency, and efficiency.

Dubai's freezones are specialized economic zones designed to attract foreign investment by offering a range of incentives, such as tax exemptions, 100% foreign ownership, and simplified business setup procedures. These zones play a crucial role in Dubai's economic development by fostering trade, innovation, and international business operations.

Dubai, one of the world's most dynamic business hubs, has seen rapid growth in its economy over the past few decades. This growth has created a demand for robust financial systems, including auditing services. Auditing in Dubai is not only a legal requirement for many businesses but also a strategic tool that helps organizations maintain transparency, enhance credibility, and improve operational efficiency. This article explores the landscape of auditing services in Dubai, highlighting their importance, regulatory environment, and key players in the market.

When it comes to payroll taxes in the United States, two of the most commonly discussed taxes are the Federal Unemployment Tax Act (FUTA) and the Federal Insurance Contributions Act (FICA). Although both FUTA and FICA are payroll taxes, they serve different purposes, are calculated differently, and have distinct impacts on both employers and employees. Understanding these differences is crucial for both employers and employees to ensure compliance with tax laws and proper financial planning.

A tax return extension allows taxpayers to delay the filing of their federal income tax return by up to six months. Instead of the usual April deadline, an extension pushes the deadline to October 15th. It's important to note that an extension only applies to the filing of the return, not the payment of any taxes owed. If you owe taxes, they are still due by the original April deadline, regardless of whether you file for an extension.

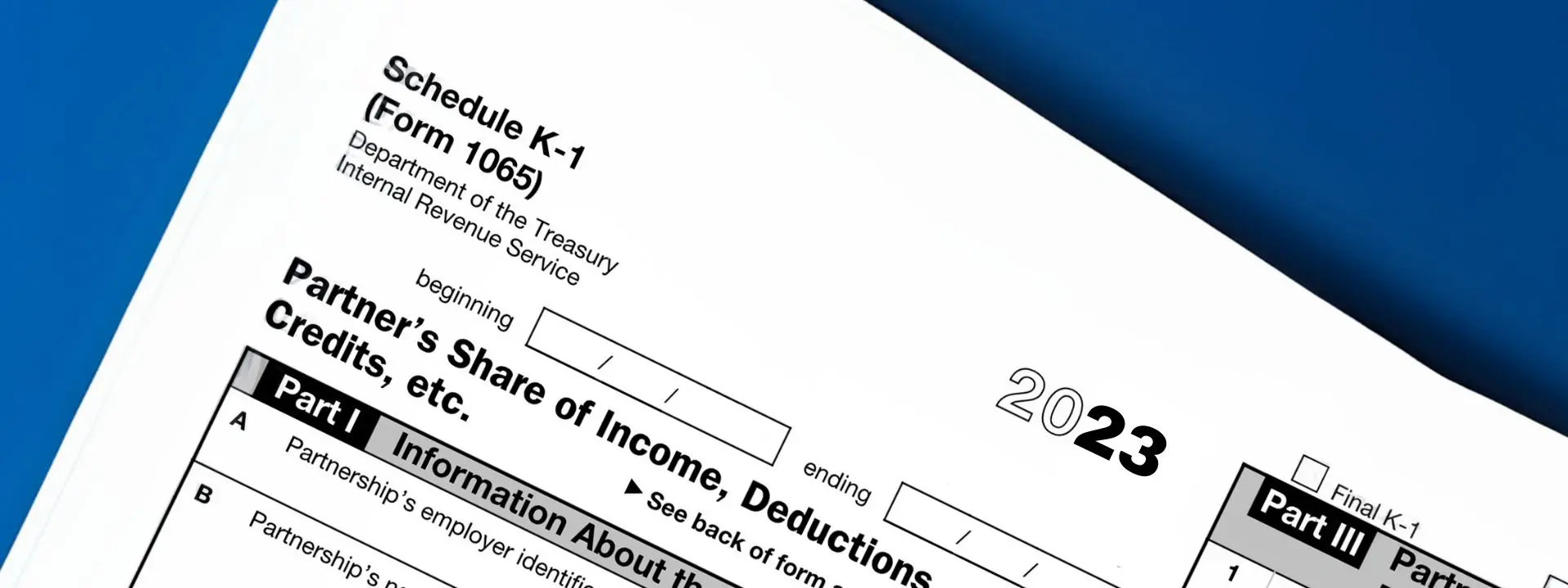

Form 1065 is an information return filed by partnerships, including limited liability companies (LLCs) that are treated as partnerships for tax purposes. It is not used to calculate tax owed by the partnership itself, since partnerships are pass-through entities. Instead, the income and other tax items pass through to the individual partners, who report these items on their personal tax returns.

Delaware is well known for being the most business-friendly state for corporations. According to the Delaware Division of Corporations 2021 Annual Report, 66.8% of all Fortune 500 companies are incorporated in Delaware.

Company Registration in UAE is a process of the prime destination for entrepreneurs and businesses due to its strategic location, tax-free environment, and world-class infrastructure. Registering a company in the UAE involves several key steps and offers various options tailored to different business needs.

Form 1028 is an application used by employers to request an EIN from the Internal Revenue Service (IRS). An EIN, sometimes referred to as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number, is a unique nine-digit number assigned to businesses operating in the United States. This number is used to identify a business entity and is crucial for tax administration.

Excise tax is a form of indirect tax levied on specific goods that are typically harmful to human health or the environment. The United Arab Emirates (UAE), including Dubai, introduced excise tax on October 1, 2017, as part of its commitment to diversify revenue sources and promote healthier lifestyle choices. The Federal Tax Authority (FTA) is responsible for the administration, collection, and enforcement of excise tax.

Dubai, part of the United Arab Emirates (UAE), has a favorable tax regime aimed at attracting international businesses. However, the introduction of corporate tax is a significant development, and businesses operating in Dubai must comply with the new regulations. Here's an overview of the timing and key considerations for corporate tax returns in Dubai.

Dubai, part of the United Arab Emirates (UAE), has implemented Value Added Tax (VAT) but does not have a traditional sales tax system. Understanding the differences between VAT and sales tax is essential for businesses and consumers to navigate the fiscal landscape effectively.

The UAE government announced the implementation of corporate tax, effective from June 1, 2023. The standard corporate tax rate is set at 9% on taxable income exceeding AED 375,000. Income below this threshold is subject to a 0% tax rate, providing relief for small businesses and startups.

Value Added Tax (VAT) is an indirect tax levied on the consumption of goods and services. It is a crucial source of revenue for many governments worldwide. Dubai, part of the United Arab Emirates (UAE), implemented VAT on January 1, 2018, following the GCC VAT framework agreement.The Federal Tax Authority (FTA) oversees the implementation and regulation of VAT in Dubai. The VAT rate in Dubai is set at 5%, applicable to most goods and services. However, certain goods and services are zero-rated or exempt from VAT.

Opening a bank account in the USA is a straightforward process, whether you are a resident or a non-resident. Here are the steps to follow:

In the realm of U.S. identification numbers, two primary types often come into discussion: the Employer Identification Number (EIN) and the Social Security Number (SSN). Although both are nine-digit identifiers issued by the U.S. government, they serve distinct functions and are used in different contexts. This article explores the key differences between EINs and SSNs, their purposes, and their applications.

A Social Security Number (SSN) is a critical identifier for anyone living and working in the United States. It is used for a variety of purposes, including tracking earnings, filing taxes, and accessing government services. Whether you are a U.S. citizen, a permanent resident, or a non-citizen authorized to work, obtaining an SSN is an important step. This article provides a comprehensive guide on how to apply for an SSN in the USA.

Australia's transfer pricing rules are an essential component of its tax regime, designed to prevent multinational enterprises (MNEs) from shifting profits to low-tax jurisdictions and thereby eroding the Australian tax base. These rules ensure that transactions between related parties, such as subsidiaries and parent companies, reflect arm's length conditions—that is, the conditions that would be expected between independent parties in comparable circumstances.

The United States is a popular destination for foreign businesses looking to expand their operations. The country has a strong economy, a large and growing market, and a favorable business environment. Registering a company in the USA involves several steps, which can vary depending on the state and the type of business structure you choose. Here is a general guide:

The United States employs a progressive income tax system, where tax rates increase as income increases. This system aims to ensure that individuals and businesses contribute to federal revenues based on their ability to pay. Understanding the income tax rates and their application is crucial for taxpayers to navigate their financial obligations effectively.

The Double Taxation Avoidance Agreement (DTAA) is a tax treaty signed between India and the United States (USA) to help taxpayers avoid paying double taxes on the same income. This agreement fosters economic cooperation and provides relief from the burden of double taxation for residents of both countries.

Cloud-based accounting software has revolutionized financial management for businesses by offering accessibility, real-time updates, and enhanced security. Here are five of the best cloud-based accounting software solutions available globally:

Managing payroll efficiently is crucial for businesses to ensure compliance with regulations and to maintain employee satisfaction. Here are the top five payroll software solutions for Australian businesses:

Managing Business Activity Statements (BAS) and Goods and Services Tax (GST) compliance is crucial for businesses in Australia. Here are five top software solutions that streamline these processes:

Efficient payroll management is crucial for businesses of all sizes, ensuring timely and accurate employee compensation. In 2024, the top payroll software options for businesses in the USA are leading the way with advanced features, user-friendly interfaces, and reliable customer support. Here are the top five payroll software solutions:

A Schedule K-1 is a tax form used in the United States to report the income, deductions, and credits from partnerships, S corporations, estates, and trusts. A Schedule K-1 document is prepared for each relevant individual (partner, shareholder, or beneficiary). A partnership then files Form 1065, the partnership tax return that contains the activity on each partner's K-1. An S corporation reports activity on Form 1120-S. Trusts and estates report the K-1 form activity on Form 1041.

An Employer Identification Number (EIN) is a nine-digit ID assigned by the Internal Revenue Service (IRS). One of five Tax ID Numbers (TINs), it’s used to identify business entities and administer tax laws. The two-digit EIN prefix indicates where the number was assigned and the subsequent seven digits identify the entity itself (e.g. XX-XXXXXXX).

A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free, and growth in the account is tax-free.

Personal income tax in Australia is a key revenue source for the government, funding essential public services such as healthcare, education, and infrastructure. Understanding how these tax rates are structured can help residents manage their finances more effectively.

The Double Taxation Avoidance Agreement (DTAA) between India and Australia aims to avoid taxpayers from being taxed twice on the same income in both countries, fostering economic cooperation and providing relief from double taxation. Here are the key features of the DTAA between India and Australia:

The balance sheet and profit and loss (P&L) statement are fundamental financial documents that collectively provide a comprehensive overview of a company's financial position and performance.

MYOB: MYOB is renowned for its comprehensive features that cater to both small businesses and larger enterprises. It offers a user-friendly interface, making it easy to track expenses, manage payroll, and file taxes accurately. Its cloud-based system allows users to access their data anytime, anywhere, ensuring seamless tax management.

The Federal Insurance Contributions Act (FICA) is a crucial law in the United States that mandates payroll contributions to fund the Social Security and Medicare programs. These programs provide financial benefits to retirees, disabled individuals, and survivors of deceased workers, as well as healthcare benefits for individuals aged 65 and older and certain younger people with disabilities. Enacted in 1935, FICA has played a significant role in ensuring the financial security and health coverage of millions of Americans.

Old-Age, Survivors, and Disability Insurance (OASDI) program, stands as a cornerstone of social welfare in the United States. Established in 1935 as part of President Franklin D. Roosevelt's New Deal, its purpose was to provide financial security to retirees, disabled individuals, and survivors of deceased workers. Initially, the program focused on providing retirement benefits to workers aged 65 and older. Over the years, the program has expanded to include survivors of deceased workers and individuals with disabilities, reflecting a broader understanding of social insurance needs.

An individual retirement account (IRA) is a long-term, tax-advantaged savings account that individuals with earned income can use to save for the future. The IRA is designed primarily for self-employed people who do not have access to workplace retirement accounts such as the 401(k), which is available only through employers. However, anyone with a retirement plan at work can also open an IRA and invest additional savings with it. You can open an IRA through a bank, an investment company, an online brokerage, or a personal broker.

Managing payroll is a critical function for businesses in the United States. Ensuring accurate and timely payroll returns is essential to comply with federal, state, and local tax laws. This article outlines the procedures for payroll returns, including filing requirements, deadlines, and best practices.

The Medicare tax is a federal payroll tax designed to fund the Medicare program, which provides health insurance to Americans aged 65 and older, as well as to younger people with certain disabilities. It is part of the Federal Insurance Contributions Act (FICA) and is paired with the Social Security tax. This article provides an overview of the Medicare tax, including its rates, who pays it, and a practical example.

1.TurboTax TurboTax is one of the most popular and widely used tax preparation software in the USA, known for its user-friendly interface and comprehensive features. It offers various editions tailored to different tax situations, including TurboTax Free Edition for simple tax returns, TurboTax Deluxe for homeowners and deductions, TurboTax Premier for investments and rental properties, and TurboTax Self-Employed for freelancers and small business owners. TurboTax guides users through the filing process with step-by-step instructions, checks for potential deductions, and offers features like W-2 import and audit support.

Social Security tax, also known as the Federal Insurance Contributions Act (FICA) tax, is a payroll tax levied on both employees and employers in the United States. It funds the Social Security program, which provides retirement, disability, and survivor benefits to eligible individuals. Here’s an in-depth look at what Social Security tax entails, its calculation, and its impact:

The Social Security Number (SSN) is a nine-digit identification number issued by the Social Security Administration (SSA) in the United States. It serves as a primary identifier for individuals and is used for various purposes, primarily related to tracking earnings and benefits associated with the Social Security program. The SSN was introduced in 1936 under the Social Security Act to track individual earnings and contributions to the Social Security program. Originally intended for social security purposes, its use has expanded over time to include identification for tax purposes, employment eligibility verification, and other administrative reasons.

The Federal Unemployment Tax Act (FUTA) is a crucial piece of legislation in the United States designed to provide funding for state unemployment insurance programs. Enacted in 1939 during the New Deal era, FUTA aims to support workers who become unemployed through no fault of their own, ensuring they have access to temporary financial assistance while they seek new employment opportunities.

QuickBooks Online: Renowned for its user-friendly interface and comprehensive features, QuickBooks Online enables real-time income and expense tracking, invoicing, and inventory management. Its cloud-based system ensures accessibility from anywhere, ideal for remote work scenarios.

In Australia, while most personal gifts between family members and friends are generally tax-free, certain scenarios can trigger taxation implications. It's crucial to understand when the Australian Taxation Office (ATO) considers a gift to be assessable income or subject to capital gains tax (CGT):

Payroll accounting in the United States is a crucial function for businesses of all sizes, ensuring employees are paid accurately and timely while complying with various federal and state regulations. Here’s an overview of the key aspects of payroll accounting in the USA:

AIME represents an individual's average earnings over their working life, adjusted for inflation. The adjustment process ensures that the earnings from earlier years, which were typically lower due to inflation, are appropriately scaled up to reflect their value in today's dollars. This adjustment is done using the national average wage indexing series, which helps to maintain the purchasing power of the earnings over time.

Property tax is a major revenue source for local governments in the U.S., funding services like schools and emergency services. Understanding property tax calculation helps homeowners anticipate expenses and potentially reduce their tax burden. Here’s a concise guide to the process:

Gift tax is a crucial aspect of the broader taxation framework in many countries. However, in Australia, the concept of a specific "gift tax" does not exist. Instead, gifts can have various tax implications under different provisions of the Australian taxation system. This article aims to clarify these implications and provide a comprehensive understanding of how gifts are treated for tax purposes in Australia.

Form 709, known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is an important document for U.S. taxpayers who make significant gifts or transfers. This form is essential for reporting taxable gifts and certain transfers that skip generations, ensuring compliance with the Internal Revenue Service (IRS) regulations.

The gift tax in the United States is a federal tax imposed on the transfer of property by one individual to another while receiving nothing or less than full value in return. The gift tax applies to the transfer of money or property to another person without receiving something of equal value in return. The giver, known as the donor, is generally responsible for paying the gift tax. However, there are numerous exemptions and exclusions that allow many gifts to be transferred without incurring tax liability.

Filing taxes can be a complex process, particularly for businesses and farmers who need to calculate income that spans multiple years. Schedule J of the U.S. Internal Revenue Service (IRS) Form 1040 is specifically designed to aid in this process. It is utilized by farmers and fishermen to average their income over a three-year period, which can potentially lower their overall tax liability. This article will provide an in-depth look at Schedule J, its purpose, and how to complete it.

Schedule C is a critical form that must be filed with the IRS Form 1120 for corporate income tax returns. It allows corporations to report taxable dividends received and claim special deductions to reduce tax liability. This form serves as an attachment to Form 1120 for corporate taxpayers to report dividends received from domestic corporations that qualify for the dividends received deduction (DRD), dividends from certain foreign corporations that qualify for the DRD, and other special deductions, such as net operating loss deductions. Without Schedule C, corporations would be unable to claim these special deductions when calculating taxable income on their 1120.

PAYG installments are designed for taxpayers who earn income that isn’t subject to PAYG withholding, including self-employed individuals, investors, and businesses. The process begins with notification, where the ATO informs eligible taxpayers of their PAYG installment obligations. Eligibility is determined by the amount of income earned from business or investments that are not subject to withholding, such as income from self-employment, rental properties, dividends, and capital gains. After lodging their tax returns, eligible taxpayers receive a notification from the ATO regarding their PAYG installment obligations.

PAYG withholding, or Pay As You Go withholding, is a crucial tax system where employers play a pivotal role in ensuring employees meet their tax obligations throughout the year. The process begins with employer registration, typically done through the ATO’s Business Portal or by other means, where they receive a unique withholding payer number. New employees are required to complete a Tax File Number (TFN) declaration, providing essential details that help determine the correct tax withholding amount. Employers must submit this declaration to the ATO within 14 days of receipt to calculate the withholding accurately.

DTAA (Double Taxation Avoidance Agreement) is a tax treaty signed between two or more countries to help taxpayers avoid paying double taxes on the same income. For Non-Resident Indians (NRIs), this agreement is particularly important as it helps them avoid being taxed twice on income earned in India and their resident country.

Australia's Pay As You Go (PAYG) system, managed by the Australian Taxation Office (ATO), simplifies tax collection for individuals and businesses by collecting income tax progressively throughout the year. It consists of two main components: PAYG Withholding and PAYG Instalments. Employers withhold taxes from payments to employees and contractors, remitting them to the ATO. Meanwhile, individuals and businesses making income not subject to withholding, such as from investments or business profits, make regular prepayments towards their annual tax liability.

In Australia, businesses are required to lodge a Business Activity Statement (BAS) to report and pay various taxes to the Australian Taxation Office (ATO). The BAS is a crucial document that helps the government monitor and collect Goods and Services Tax (GST), as well as other taxes such as Pay As You Go (PAYG) withholding and Fringe Benefits Tax (FBT). The BAS typically includes several key components: GST, a broad-based tax of 10% on most goods, services, and other items sold or consumed in Australia. Businesses registered for GST must collect this tax on behalf of the government and remit it through their BAS. PAYG withholding covers the amounts withheld from payments made to employees, contractors, and other businesses where the payee has not quoted an Australian Business Number (ABN). Businesses may also need to pay PAYG instalments, which are advance payments towards their expected income tax liability for the current financial year. If a business provides fringe benefits to its employees or associates, it must report and pay FBT through the BAS. Fringe benefits can include items like company cars, health insurance, and entertainment expenses. Additionally, businesses involved in the wine industry or selling luxury cars may need to report and pay Wine Equalisation Tax (WET) and Luxury Car Tax (LCT) through their BAS, if applicable.

A payroll return, often referred to as the Pay As You Go (PAYG) withholding report, is a mandatory submission by employers to the ATO. It details the total amount of tax withheld from employee salaries and wages. This process ensures that the correct amount of tax is collected throughout the year, reducing the burden on employees at the end of the financial year.

Australia's tax return system is an essential aspect of the country's financial framework, ensuring that both individuals and businesses contribute to the nation's revenue. Understanding how to navigate this system can be beneficial, whether you're a resident, a business owner, or an expatriate. This article aims to provide a comprehensive overview of the Australian tax return process, its importance, and how to manage it effectively.

The net investment income tax, or NIIT, is an IRS tax related to the net investment income of certain individuals, estates and trusts. More specifically, this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income (MAGI) surpasses the filing status-based thresholds the IRS imposes. The NIIT is set at 3.8% for 2024, as it was for 2023.

Self-Managed Superannuation Funds (SMSFs) in Australia offer a way for individuals to control their own retirement savings. However, managing an SMSF comes with complex accounting and taxation requirements. Effective accounting practices play a vital role in managing SMSFs by ensuring accurate financial reporting, adherence to regulatory standards, and efficient asset management. Key accounting responsibilities for SMSFs include maintaining detailed records of all transactions, encompassing contributions, investments, expenses, and disbursements. Thorough record-keeping promotes transparency and simplifies the audit process. SMSFs are required to compile yearly financial statements, comprising a Balance Sheet, Profit and Loss Statement, and Member Statements. Accurate valuation of SMSF assets is critical for calculating the fund's net asset value and staying compliant with regulations, with assets needing to be valued at their market worth at least once a year. Additionally, SMSFs must comply with taxation rules, including lodging an annual tax return with the Australian Taxation Office (ATO). Proper accounting ensures accurate calculation of tax liabilities and entitlements.

Reducing capital gains tax in the United States can be achieved through several strategies. Holding investments for over a year is one common method, as long-term capital gains (on assets held for more than one year) are taxed at lower rates than short-term gains (on assets held for one year or less). Long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income, whereas short-term gains are taxed at ordinary income tax rates. Another effective strategy is to use tax-advantaged accounts, such as 401(k)s, IRAs, Roth IRAs, or Health Savings Accounts (HSAs). These accounts offer tax deferral or tax-free growth, significantly reducing capital gains taxes.

Self-Managed Super Funds (SMSFs) offer a flexible and personalized approach to managing your retirement savings. Unlike traditional superannuation funds, SMSFs allow you to have direct control over your investment choices. However, with this control comes a significant responsibility to comply with regulatory requirements.

A capital gains tax is a tax imposed on the sale of an asset. The long-term capital gains tax rates for the 2023 and 2024 tax years are 0%, 15%, or 20% of the profit, depending on the income of the filer. An investor will owe long-term capital gains tax on the profits of any investment owned for at least one year. If the investor owns the investment for one year or less, short-term capital gains tax applies. The short-term rate is determined by the taxpayer's ordinary income bracket.

IRS Form 5695 is the paperwork clients can file with their income taxes to take advantage of financial incentives to go green. The Form 5695 worksheet is for calculating and claiming non-business energy property credits or residential energy-efficient property credits. This form isn’t limited to the solar tax credit: It also applies to other renewable energy upgrades such as geothermal heat pumps, wind turbines, fuel cells, solar water heating systems, biomass and many other alternative energy devices.

Itemized deductions are essentially a list of expenses you can use to reduce your taxable income on your federal tax return. They include medical expenses, taxes, the interest you pay on your home mortgage, and donations to charity. Taxpayers who itemize add up all of their deductible expenses and subtract the total from their adjusted gross income to reach their taxable income.

What is Form 8858? Form 8858, “Information Return of U.S. Persons With Respect to Foreign Disregarded Entities and Foreign Branches,” is a tax form used by the IRS to collect information about certain foreign companies, or entities, owned by U.S. taxpayers. It reports information about the company’s ownership and financial details.

Form 1120, the standard tax form used by C corporations in the United States, is essential for reporting their financial information to the IRS. This form details a corporation’s income, expenses, and other financial activities over the tax year, enabling the IRS to assess the corporation’s tax liability. It must be filed annually, regardless of whether the corporation made a profit or incurred a loss during the year.

Form 926 is filed by US citizens or green card holders who transfer property to a foreign corporation, as part of the IRS’s efforts to track and tax such transfers appropriately. This form is used to report the transfer of property and to calculate any taxes owed as a result of the transfer.

Form 5472 is an information return required by the IRS to capture detailed data about certain transactions between a U.S. corporation with significant foreign ownership or a foreign corporation engaged in a U.S. trade or business, and its foreign shareholders or other related foreign parties. The goal is to ensure transparency and compliance with U.S. tax laws.

Form 1040-NR, also known as the U.S. Nonresident Alien Income Tax Return, is a critical document for nonresident aliens who have earned income from U.S. sources. Nonresident aliens are individuals who do not pass the green card test or the substantial presence test, which are the primary criteria for determining residency status for tax purposes in the United States. This form is essential for reporting and paying taxes on various types of income earned within the U.S., such as wages, salaries, tips, interest, dividends, and other forms of compensation.

Form 1040, the U.S. Individual Income Tax Return, is a linchpin in the annual tax filing process for American taxpayers. Serving as the primary document for reporting personal income and claiming deductions, credits, and exemptions, it encapsulates the financial snapshot of an individual's fiscal year.

An S Corporation, or S-corp, is a unique corporate structure that offers the liability protection of a corporation while enjoying the tax benefits of a partnership. The "S" designation refers to Subchapter S of the Internal Revenue Code, which outlines the specific tax rules for this type of corporation.

In the intricate world of finance, maintaining meticulous records is the linchpin of a successful business. Accounts Payable (AP) reconciliation stands out as a critical process in ensuring financial accuracy, enhancing transparency, and fortifying the financial health of a company.

Payroll management is a critical aspect of organizational efficiency, encompassing the administration of employee compensation, benefits, and tax withholdings. Efficient payroll systems ensure timely and accurate payments, fostering employee satisfaction and compliance with legal obligations.

Digital transformation has revolutionized bookkeeping, ushering in a new era of efficiency and accuracy. Traditional ledgers and manual record-keeping have given way to sophisticated digital tools, reshaping the landscape of financial management.

Hedge fund accounting is a specialized field that plays a crucial role in managing the financial intricacies of hedge funds, investment vehicles known for their complex strategies and risk profiles.

The IRS is taking significant steps to safeguard businesses against fraud related to the Employee Retention Credit (ERC). Criminal Investigation (CI) is conducting educational sessions for tax professionals as part of its ongoing efforts.

A 𝐬𝐭𝐫𝐚𝐭𝐞𝐠𝐲 used by clever 𝐂𝐏𝐀𝐬 for their Real Estate investors to save taxes. What they exactly do? The answer is "𝐜𝐨𝐬𝐭 𝐬𝐞𝐠𝐫𝐞𝐠𝐚𝐭𝐢𝐨𝐧 𝐬𝐭𝐮𝐝𝐲"! Let's understand how this is done with simple and crisp examples.

We're thrilled to announce a transformative update that will positively impact your journey to becoming a Certified Public Accountant! The policy governing the lifespan of passed sections of the CPA Exam has been significantly improved.

recent post

What are the benefits of outsourcing of accounting, taxation, and payroll ?

Outsourcing accounting, taxation, and payroll in the USA offers cost savings by reducing in-house staffing and operational expenses. It ensures compliance with tax laws and regulations through expert handling, minimizing risks of errors and penalties. Additionally, it frees up time for businesses to focus on core operations and strategic growth.

Outsourcing Of Accounting, Taxation And Payroll Dubai

In Dubai, outsourcing accounting services includes bookkeeping, financial reporting, and audits to ensure compliance with UAE regulations. Taxation outsourcing helps businesses manage VAT filings, tax planning, and adherence to local tax laws. Payroll outsourcing streamlines salary processing, WPS compliance, and employee benefits, ensuring efficiency and accuracy in HR functions.

Types of Outsourcing in Accounting, Payroll, and Taxation

Outsourcing in accounting involves delegating tasks such as bookkeeping, financial reporting, and audits to external firms. Payroll outsourcing handles salary processing, tax calculations, and employee benefit management. Taxation outsourcing focuses on filing tax returns, tax planning, and ensuring compliance with local and international tax laws.

Benefits of Outsourcing Accounting

Outsourcing accounting provides cost savings by reducing the need for in-house staff and infrastructure. It ensures access to expert financial management and up-to-date compliance with regulations. Additionally, it allows businesses to focus on core activities, improving efficiency and growth.

What is Cloud Accounting?

Cloud accounting is the practice of using internet-based software to manage and process financial transactions, records, and reporting. Unlike traditional accounting systems that are installed locally on computers, cloud accounting solutions are hosted on remote servers and accessible from anywhere with an internet connection. These systems provide real-time data updates, improved collaboration, and enhanced security. Popular examples include QuickBooks Online, Xero, and Zoho Books.

Discovery Our Culture

Company’s culture is a part important of any business