Understanding Form 8858: Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

Who Needs to File Form 8858?

U.S. persons who are required to file Form 8858 include:

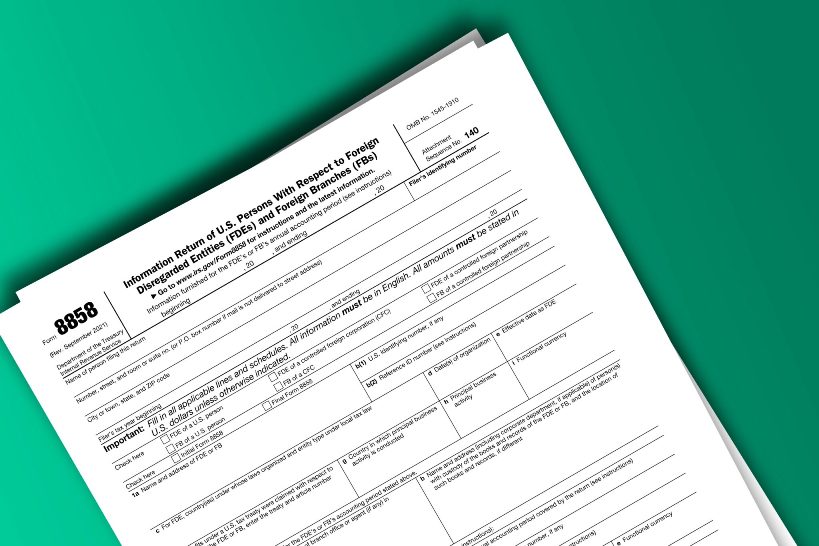

Key Components of Form 8858

The form contains a lot of different pieces and each of these pieces ask for further information as in —

Part I: Identification: This section is to obtain the name, address and identification number of the filer as well as the FDE or FB.

Part II : Information with Respect to FDE of FB: This will include information on the operations of the entity, the business activities, the functional currency, and place of organization.

Part III: Income Statement: Contains a basic income statement of the filer including income, expenses, and other financial information.

Part IV: Balance Sheet: This section needs details about the assets, liabilities, and equity of the entity.

Part V: Other Information — These are further informations regarding taxes paid by the entity and its operations.

Filing Deadlines and Penalties

Form 8858 is due at the same time as the filer’s annual tax return, including extensions. Failing to file Form 8858 or filing it inaccurately can result in significant penalties. The IRS may impose a penalty of $10,000 per form for failure to file, and additional penalties may apply for continued non-compliance.